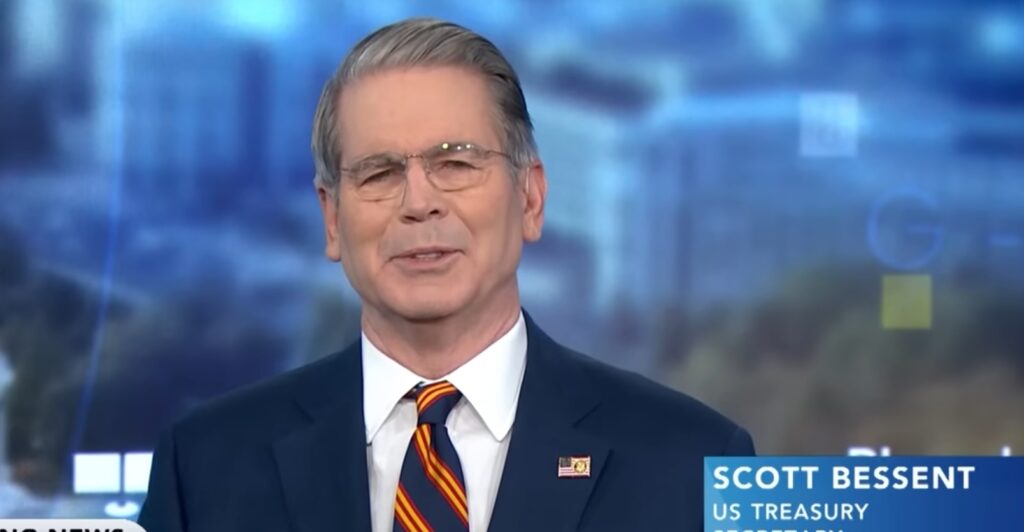

Washington, D.C., July 22, 2025 — Treasury Secretary Scott Bessent has called for a sweeping review of the Federal Reserve, urging a re-examination of the central bank’s overall mission and effectiveness. His remarks, made in a high-profile CNBC interview, come at a time of heightened tension between the White House and the Fed, and add fuel to the ongoing debate over the central bank’s policies and governance.

“What we need to do is examine the entire Federal Reserve institution and whether they have been successful,” Bessent stated during his appearance on Squawk Box. “If this were the FAA and we were having this many mistakes, we would go back and look at why this has happened.”

🔍 A Deeper Review Beyond Building Renovations

While the Fed is already under scrutiny for cost overruns in a $2.5 billion building renovation, Bessent’s comments suggest the controversy has outgrown construction concerns. He emphasized that the central bank’s core mission—managing inflation and employment—should be evaluated thoroughly.

The remarks appear to align with growing frustration in the administration regarding the Fed’s recent policy actions and internal management. Officials reportedly plan to inspect the renovation project in person, further underlining the administration’s dissatisfaction.

💼 Bessent at the Center of Fed-Powell Drama

Bessent, a key figure in the administration’s economic team, has been linked to efforts to mediate tensions between President Donald Trump and Fed Chair Jerome Powell. There were recent reports suggesting the president was considering removing Powell—an act many legal experts deem questionable. While Trump denied immediate plans to oust the Fed chair, Bessent’s role in persuading Trump to hold off has drawn attention.

“President Trump solicits a whole range of opinions and then makes a decision,” Bessent said, neither confirming nor denying his influence in the decision.

📉 Bessent Supports Rate Cuts as Inflation Cools

Reinforcing the administration’s stance on monetary policy, Bessent argued that the Federal Reserve should resume cutting interest rates, especially with inflation showing signs of sustained moderation.

“They were fear mongering over tariffs, and thus far we have seen very little, if any, inflation,” Bessent noted. “We’ve had great inflation numbers. I think this idea of them not being able to break out of a certain mindset— all these Ph.D.s over there, I don’t know what they do.”

The Fed last cut its benchmark interest rate in December, wrapping up a brief easing cycle. Despite that, mortgage and Treasury yields have paradoxically moved higher, raising questions about the Fed’s approach and communication strategy. Market expectations currently indicate a potential rate cut in September, though the Fed has yet to confirm such plans.

⚖️ Political & Legal Pressure Mounts on Fed Chair Powell

Adding another layer of controversy, Rep. Anna Paulina Luna (R-FL) has requested that the Justice Department investigate Jerome Powell for allegedly providing misleading testimony to Congress regarding the Fed’s renovation project. Luna accuses Powell of criminal misconduct, a charge that further complicates the relationship between the central bank and lawmakers.

🏛️ What’s Next for the Federal Reserve?

It remains unclear what form Bessent’s proposed review would take—whether internal, congressional, or through a bipartisan commission. What is evident, however, is the growing appetite within the administration for greater accountability and transparency at the Fed.

With the 2026 election cycle approaching, monetary policy could become a focal point of political discourse, especially as Americans navigate a complex economic landscape marked by moderating inflation, sticky interest rates, and a divided outlook on growth.